tax on unrealized gains uk

This reflects the 10k investment and the 5k unrealised gain. Holding security for a long time may reduce the tax implication as it will be treated as long-term capital gains tax.

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Do you pay tax on Unrealised gains.

. 1 day agoSummary and Background. You have an unrealized gain of 3000. But one aspect of his proposal a minimum 20 tax on the unrealized gains of US.

The investor can plan when to sell the security and realize his gains. 3 percent only for the PIT taxpayers if the tax value of an asset is not determined ie. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains.

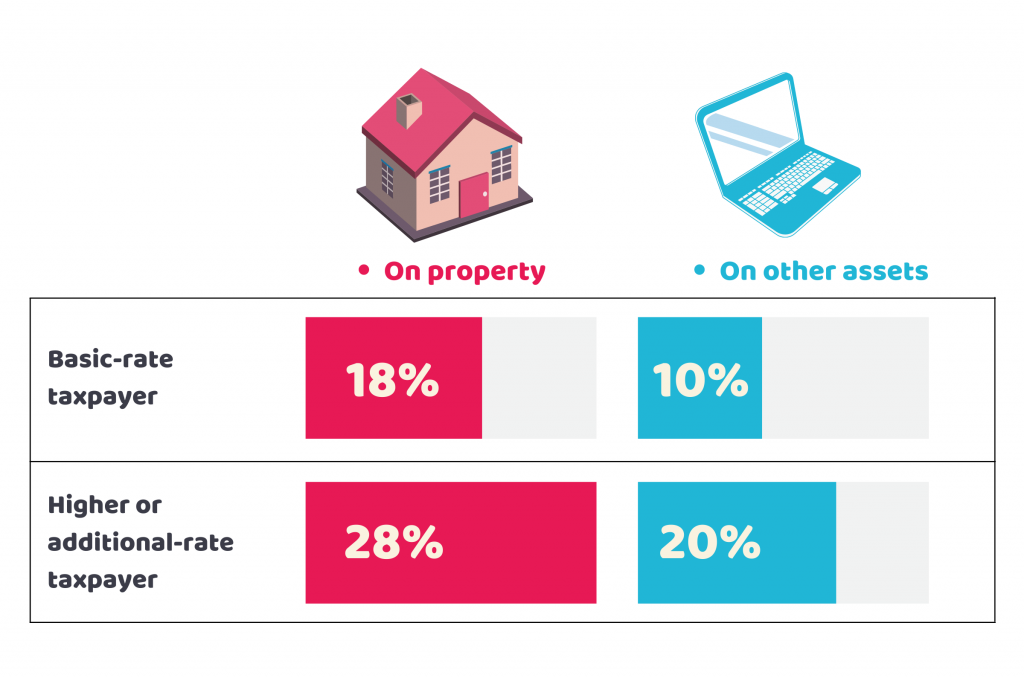

Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Generally unrealized gainslosses do not affect you until you actually sell the security and thus realize the gainloss.

Taxes are paid only on realized gains. You buy 1 ETH for 4000. To help fund his over-the-top spending proposal of 58 trillion in post-COVID Fiscal Year 2023 President Joe Biden has called for a brand-new tax.

The top 0002 will be taxed yearly on unrealized gains from. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k. You later sell your ETH for 3500.

If you were to sell this position youd have a realized gain of 2000 and owe taxes on it. Thus by knowing the Unrealized Gain the Company can forecast the amount of tax to be paid if they sell the securities. If according to separate provisions tax deductible costs on the transfer of an asset cannot be recognized.

You have a realized loss of 500. 19 percent for the CIT and PIT taxpayers if the tax value of an asset is determined. Biden to Propose 20 Tax Aimed at Billionaires Unrealized Gains.

A new tax could require the wealthy to pay least 20 even on unrealized appreciation. Under FRS102 we need to show the investments at market value at year end which is easy to do as they are publicly. So President Biden is proposing taxing the unrealized gains of the richest Americans taxing assets the wealthy havent yet cashed out on.

1 day agoSome billionaires pay no tax at all. And the value of their unrealized gains differs significantly about 100000 for the bottom 20 versus 17 million for the top 10 on average according to the Federal Reserve. The new billionaire income tax will only target about 600 to 700 Americans.

You will then be subject to taxation assuming the assets were not in a tax-deferred account. Tax could generate 360 billion in new revenue over 10 years. Its a big idea thats getting even bigger pushback.

The minimum tax would be based on all economic income which the proposal refers to as total income including unrealized gain. Its a big idea thats getting. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax. You buy 1 ETH for 4000. So President Biden is proposing taxing the unrealized gains of the richest Americans taxing assets the wealthy havent yet cashed out on.

Its the gain you make thats taxed not the. Some billionaires pay no tax at all. Households worth 100 million or more is drawing skepticism from tax experts.

Senators presented similar plan to pay for Build Back Better. Share this article Copied. The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510.

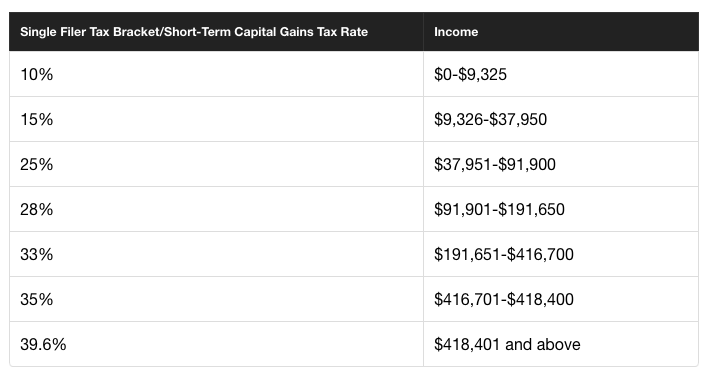

The tax rate shall amount to. Unrealised gains on investment shares - is Corp tax chargeable. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Below are one economists estimates of what the top 10 wealthiest Americans would. Limited company made 100k of investments during its company year - all investments in publicly traded shares not funds or unit trusts they bought shares directly in companies. The price of BTC has increased by 3000 but you havent sold your asset.

According to the White House billionaires in America pay income tax at a rate thats just half that of the average worker. The tax would be effective for taxable years beginning after December 31 2022. On March 28 2022 the Biden Administration proposed a 20 minimum tax on individuals who have more than 100 million in assets.

You buy 05 Bitcoin for 30000. So President Biden is proposing taxing the unrealized gains of the richest Americans taxing assets. Without taxing unrealized gains at death the revenue-maximizing capital gains tax rate is about 30 percent in the long run and about 20 percent in the short run.

President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of. The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as. If theres no sale theres no cash to pay the tax typically says Steve Rosenthal senior fellow in the Urban-Brookings Tax Policy.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

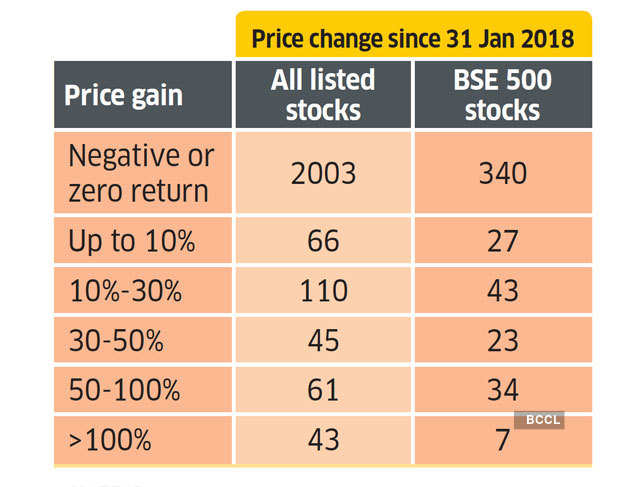

Ltcg Tax On Equity Here S A Trick To Lower Your Tax On Capital Gains From Equity

The Unintended Consequences Of Taxing Unrealized Capital Gains

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

Day Trading Don T Forget About Taxes Wealthfront

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

What Is Capital Gains Tax Quora

Unintended Consequences Of Taxing Unrealized Capital Gains Investing Com

How To Avoiding Capital Gains Tax On Property Uk Accotax

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)